Okay, so another crypto crash. October 10th, 2025, to be exact. Does anyone even blink anymore? Feels like we’re averaging, what, three of these a year now? The FalconX report says DeFi is “experiencing softness.” Softness? Give me a break. It’s a bloodbath out there.

DeFi Token Exodus: Graveyard or "Correction"?

The Great DeFi Token Exodus?

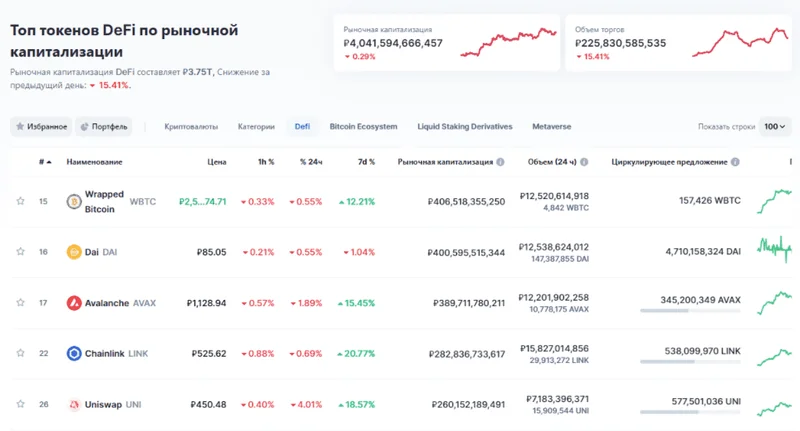

Two out of 23 leading DeFi tokens in the green YTD? That’s not a market; that’s a graveyard. Down 37% QTD on average. The only question is whether to call it a “correction” or a full-blown implosion. But hey, "mixed price action reveals some nuances," according to the report. Always gotta find a silver lining for the VCs who are bagholding this garbage, right?

The report tries to spin it as investors being “opting for safer names with buybacks or allocating to tokens with fundamental catalysts.” Translation: everyone’s running for the exits and piling into whatever looks vaguely less likely to go to zero. HYPE and CAKE are the examples given. Seriously? We're celebrating *less* awful performance?

And then there's the lending sector. Apparently, investors are “crowding lending names in the selloff, considering lending and yield-related activity is often seen as stickier than trading activity in a downturn." Stickier? Is that the best they could come up with? It's like saying a cockroach infestation is "stickier" than a house fire.

Why do I even bother reading this stuff? Oh right, because someone has to call out the BS.

Speaking of BS, my cable company just raised my rates *again*. Seriously, how many times can they get away with this? It's like they're actively trying to make me cancel my service. Maybe I should just switch to streaming everything. But then I'd have to deal with *more* subscription fees. Ugh.

DeFi's "Shuffle": Less Money, More Gambling?

The Subsector Shuffle: Musical Chairs with Crypto

So, the "valuation landscape" is shifting. Some DeFi subsectors are "becoming more expensive," while others are "cheapening." What does that even mean? It means some people are losing less money than others. Spot and perpetual decentralized exchanges (DEXes) have seen declining price-to-sales multiples. Because, offcourse, nobody's using them.

But wait, some DEXes like CRV, RUNE, and CAKE (again with CAKE!) have posted greater 30-day fees. Okay, so *some* people are still gambling. Doesn’t mean it’s a healthy ecosystem.

Here's the part that really gets me. The FalconX report suggests investors expect "perps to continue to lead." Perps? As in, perpetual futures? So, the future of DeFi is… more leveraged gambling? That's the innovation we're all waiting for? Maybe I'm just too old for this.

And on the lending side, they think investors are "looking to more fintech integrations to drive growth." AAVE’s upcoming high-yield savings account and MORPHO’s Coinbase integration are cited as examples. So, DeFi is turning into… banks? Except with extra steps and more opportunities to get rug-pulled?

I don't get it.

DeFi's "Opportunities": For Whom, Exactly?

Is There Even a Future Here?

The report concludes that these trends "reveal potential opportunities from dislocations in the wake of 10/10." Opportunities for *who*? The VCs who need to offload their bags? The insiders who are already shorting everything? Definitely not the average retail investor.

The big question is whether these changes mark "the beginning of a broader shift in DeFi valuations or if these will revert over time." Translation: is this the end, or just a temporary setback before the next wave of hype?

DeFi Token Performance & Investor Trends Post-October Crash

Honestly, I don't know. And frankly, I don't care anymore. Maybe I'm just cynical. Maybe I've seen too many of these cycles. Maybe I'm just tired of the endless promises and the inevitable disappointments.

So, Are We Just Rearranging Deck Chairs on the Titanic?

I ain't gonna lie: this whole DeFi thing feels like a slow-motion train wreck. Maybe there's *something* salvageable here, but I'm not holding my breath. I'm out.